non filing of income tax return notice reply

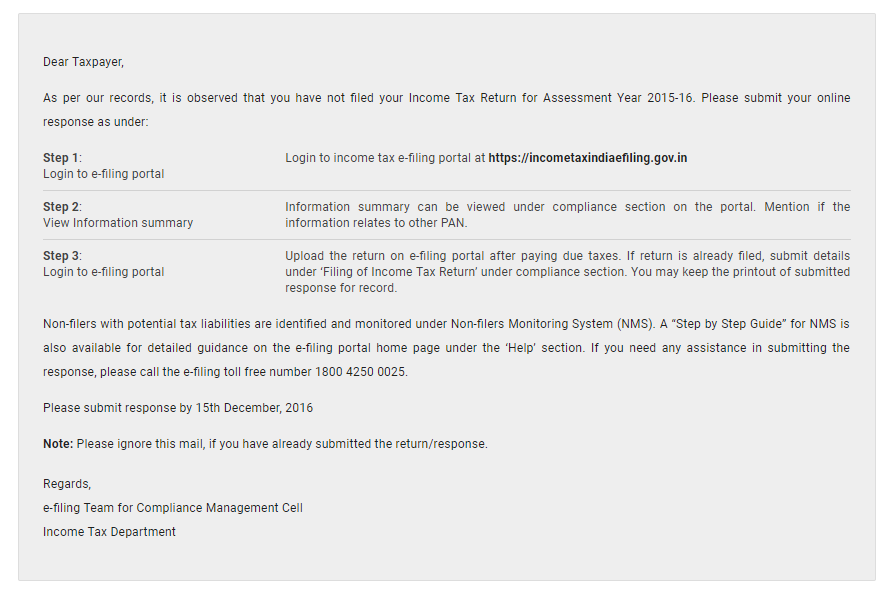

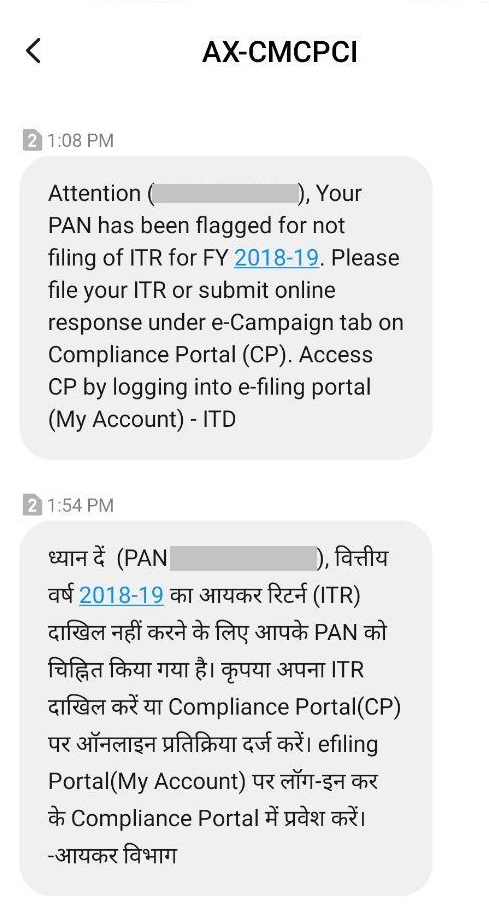

It can happen that you missed filing your return while your employer has deducted the tax. Responding to the Notice for Non-Filing of Return In most of the cases the income tax department sends out income tax notice via mobile SMS or electronic mails.

Sample Tax Notice Response Valid Prettier Models Irs Response Throughout Irs Response Letter Template 10 Profe Letter Templates Lettering Name Tag Templates

Click on respective Financial Year under the e-Campaign Response on filing of Income Tax Return as shown above to submit the response.

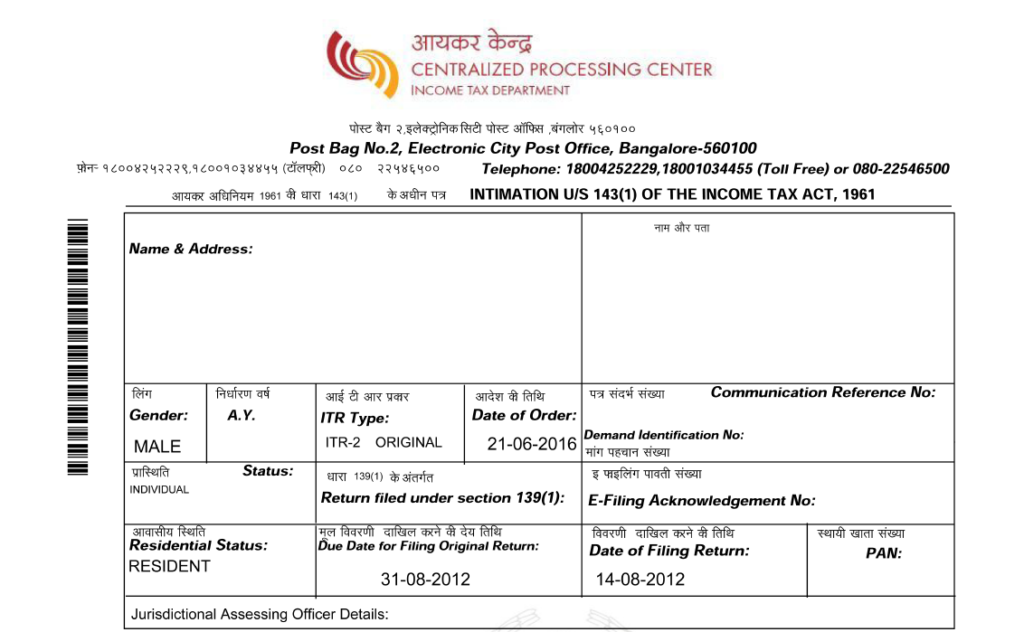

. How to Reply to Notices Online Log in to the portal and find the Compliance tab where you can see the non-filers information. The issue of a notice under section 148 of the Income-tax Act the Act calling upon the Taxpayer to file a return of income for the year specified in the notice is the starting point of the Re-assessment Re-audit proceedings. In case you have allready filed your income tax return please submit a copy of the acknowledgement receipt.

Yes You can either file the return as a fresh revised return incase the time provided for filing the return in a particular assessment year has not lapsed or alternatively you can also choose to respond to Notice us139. With reference to abovementioned subject we would like to inform you about the fact that the due date of filing of Income Tax Return for AY. This article will explain how to reply to Notice for Non Filing of Income Tax Return.

_____as due from me by way of income-tax. Taxpayers are required to submit the response on the e-filing website following the steps below. In case if you have already filed income tax return but not declared correct tax liability pay due taxes and file revised return.

If you have received the notice manually ie by post or by hand etc then you have to draft a suitable reply to the income tax authority issuing the notice detailing the exact reasons why you did not file the return of income. Login to e-filing portal Login to e-filing portal at httpincometaxindiaefilinggovin and click on Worklist. You can respond to the notice through your income tax e-Filing Account.

Under the View and Submit Compliance tab you will find a Filing of Income Tax return option through which you. What to do if you receive a notice for non-filing of Income Tax Return. It is also possible that you get filed your returns after the due date.

Returns Not Filed It can happen that you missed filing your return while your employer has deducted the tax. So these notices are to be replied with the required information. Notice for Non-Disclosure of Income.

You can reply to such a notice by following these steps-Login to your account on the website incometaxindiaefilinggovin. A Re-assessment proceeding also referred as re-opening of the assessment is initiated by the assessing officer when he. Now under Compliance tab Select Compliance portal option and click on Confirm button.

Registered users can log in with their user-id and. 2011-12 which you are required to file under the provisions of section 139 1 of the income tax act1961. Following are some of the main reasons why you might receive a notice from the Income tax Department.

Penalties leviable under the Income-tax Act. All groups and messages. However once the time provided for filing the return for a particular assessment year has lapsed you will not be able file the return as a fresh revised return and.

Taxable individuals and entities under GST are obliged to file several GST returns. If Information is correct file income tax return after paying due taxes and in case you are not liable to file return submit an online response under Response on non-filing of return on Compliance Portal. Under GST return filing plays a very significant role.

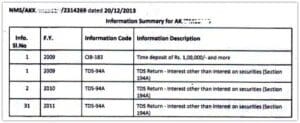

Tax authorities use this information to calculate tax liability. It will redirect to compliance portal. View Non-filers information Non-filers Information and Information.

You can respond to the notice of non-filing of returns via online channel by logging in to the income tax departments e. How to Respond to 148 Notice. Filed along with the return of income Thanking you Yours faithfully RUSHABH INFOSOFT LTD.

Responding to the Notice for Non-Filing of Return. In which you have shown a sum of Rs. A return is a document which contains the details of the income which a taxpayer is required to file with the tax administrative authorities.

How to reply to non-filing of Income Tax Return Notice AY 2019-20. It is noticed from the list of non filers based on annual information return in this office that you have not filed your income tax return for the ay. 2013-14 was 30 th September 2013.

Penalties for Late Income Tax Return Filing in India Above information will be a useful guide when you are replying to a compliance guide. You are only required to reply to the govt the reason why you didnt file your ITR. REPLY TO NOTICE UNDER The Income-tax Officer Ward Dear Sir.

How to respond to the notice for Non-filing of Income Tax Return Click here to login to efiling website. If you have not filed the Income Tax Return by July 31 you will get a notice on non-filing of ITR. Below is the attached screenshot for your reference.

However due to additional requirement of first uploading the tax audit report by the auditor and then uploading the Income tax return by the Company on the Income Tax. There is no need of personal presence in this matter. Click on Compliance Menu Tab and you will be re-directed to the Compliance portal.

In most of the cases the IT department sends notices by emails or by SMS. Penalty for default in making payment of Self Assessment Tax As per section 140A1 any tax due after allowing credit for TDS advance tax etc along with interest and fee should be paid before filing the return of income. Now Go to E- Campaign tab a notification will come under Non- filing of return.

You can view the. You could get this notice within a year of the end of the assessment year for which return has not been filed. In both these scenarios you will be sent a notice asking you to file returns within the.

Below is the screen shot of the page for your reference. If you select. However such notices are just an intimation or request for further information in most cases.

File your ITR as soon as possible and attach the ITR-V or reply with Return under preparation. However you should also not ignore this notice. If you have received this notice you should not panic.

When any one receives notice from the Income Tax department panic sets in. In this connection I would like to state that. Below are the step by step guidelines on how to respond to the notice.

In most of the cases the income tax department sends out income tax notice via mobile SMS or electronic mails. Disclaimer- All the information given is from credible and authentic resources and.

How To Respond To Non Filing Of Income Tax Return Notice

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

How To Reply Notice For Non Filing Of Income Tax Return

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

Understand Income Tax Notices Learn By Quickolearn By Quicko

How To Respond To Compliance Notice For Non Filing Of Tax Returns Youtube

How To Respond To Non Filing Of Income Tax Return Notice

How To Read And Respond To Your Notice From The Irs

How Should You Respond To A Defective Income Tax Return Notice

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

A Guide To Handle A Notice For Non Filing Of Income Tax Return Mymoneysage Blog

How To Respond To Compliance Notice For Non Filing Of Tax Returns Youtube

How To Respond To Non Filing Of Income Tax Return Notice

How To Reply Notice For Non Filing Of Income Tax Return

How To Respond To Non Filing Of Income Tax Return Notice

How To Respond To Non Filing Of It Return Notice Learn By Quickolearn By Quicko

Notice For Not Filing Income Tax How To Respond To It Learn By Quickolearn By Quicko